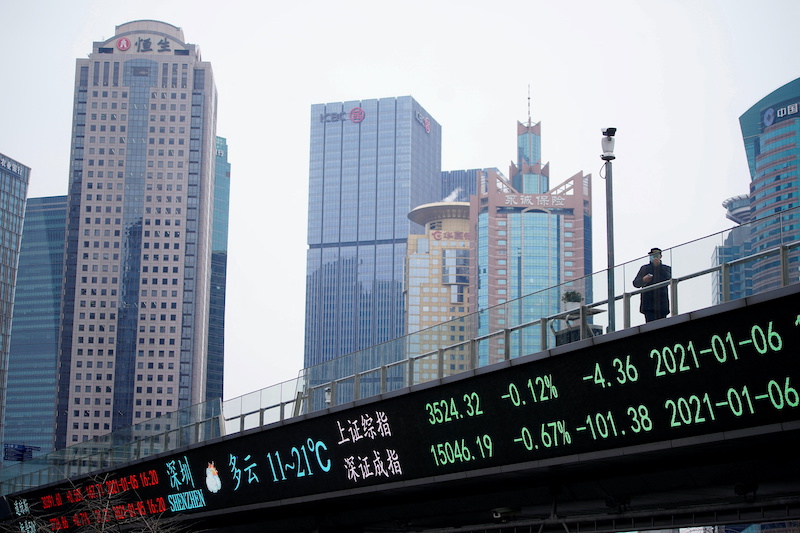

Despite encouraging data showing a resurgence in China’s manufacturing sector after six months of contraction, Asia-Pacific stock markets faced a downward trend.

China’s Manufacturing Shows Signs of Recovery

Over the weekend, official data revealed that China’s factory activity in September had expanded for the first time since April. China’s Purchasing Managers’ Index (PMI) climbed to 50.2 in September, surpassing Reuters’ expectations of 50.0.

However, the impact of this positive news was somewhat muted as China’s markets were closed for the weeklong Golden Week holiday. South Korean and Hong Kong markets were also closed due to holidays, limiting immediate market response. koin303

Mixed Performance Across the Region

Japan’s Nikkei 225 experienced a 0.31% decline, closing at 31,759.88, while the Topix slipped 0.39% to finish at 2,314. Despite this dip in market performance, sentiment among Japan’s major manufacturers showed improvement. The closely-watched central bank tankan survey revealed a score of 9 in the third quarter, up from 5 in the previous three months.

Australia’s S&P/ASX 200 followed the regional trend, falling by 0.22% to close at 7,033.2.

Mixed Results in the U.S.

On Friday in the United States, the three major stock indexes exhibited mixed results. The Dow and S&P 500 closed the session lower by 0.5% and 0.3%, respectively, marking a challenging week for these indexes. In contrast, the Nasdaq Composite edged up by 0.1%. coin303

Over the weekend, U.S. legislators managed to reach a temporary agreement, averting a government shutdown and providing some relief to market participants.

Despite the positive manufacturing data from China, the overall sentiment in the Asia-Pacific region remained cautious, influenced by various factors, including market closures due to holidays and mixed performances in global markets.